Spain is one of the world’s leading players in the process of financial digitalisation. In fact, according to the Study of Digital Banking Maturity 1 conducted in 2020 by Monitor Deloitte, Spanish banks rank second worldwide in digital transformation, preceded only by Turkey.

Therefore, Spanish banks seem to have fully caught up with the worldwide trend that has seen a huge increase in the time spent on financial applications. In fact, according to AppAnnie's latest report2, the worldwide increase was 45% (excluding China).

This is not a 2020 novelty, not a product of the Covid-19 pandemic's push for digitalisation. According to the Deloitte study, there had already been an acceleration of the process in which Mobile is the leading player. Gerard Sanz, a partner at Monitor Deloitte said: "We see that Spanish banks are investing more and more in the digital acquisition of end-to-end products, trying to offer an online experience that is as simple and friendly as other business sectors."

Given this data and the considerations, we pose three questions:

1. How do real users feel about the account opening process?

2. How many clicks does it take to open a bank account?

3. Do major banks allow you to open an account from a cell phone?

How do real users feel about the account opening process?

Together with Fintastico, we selected 16 banks: 15 of the main traditional banks and challenger banks in Spain, and an internationally recognised model of digital banking (N26). The main drivers of choice were: number of users, advanced digitalisation and a common user experience in the acquisition funnel.

The banks analysed were nine traditional banks (Abanca, Bankoa, BBVA, CaixaBank, Cecabank, Ferratum Bank, Kutxabank, Santander, Unicaja) and seven neobanks (Bankinter, Bnext, EBN Banco, Evo Banco, Imagin, N26, OpenBank).

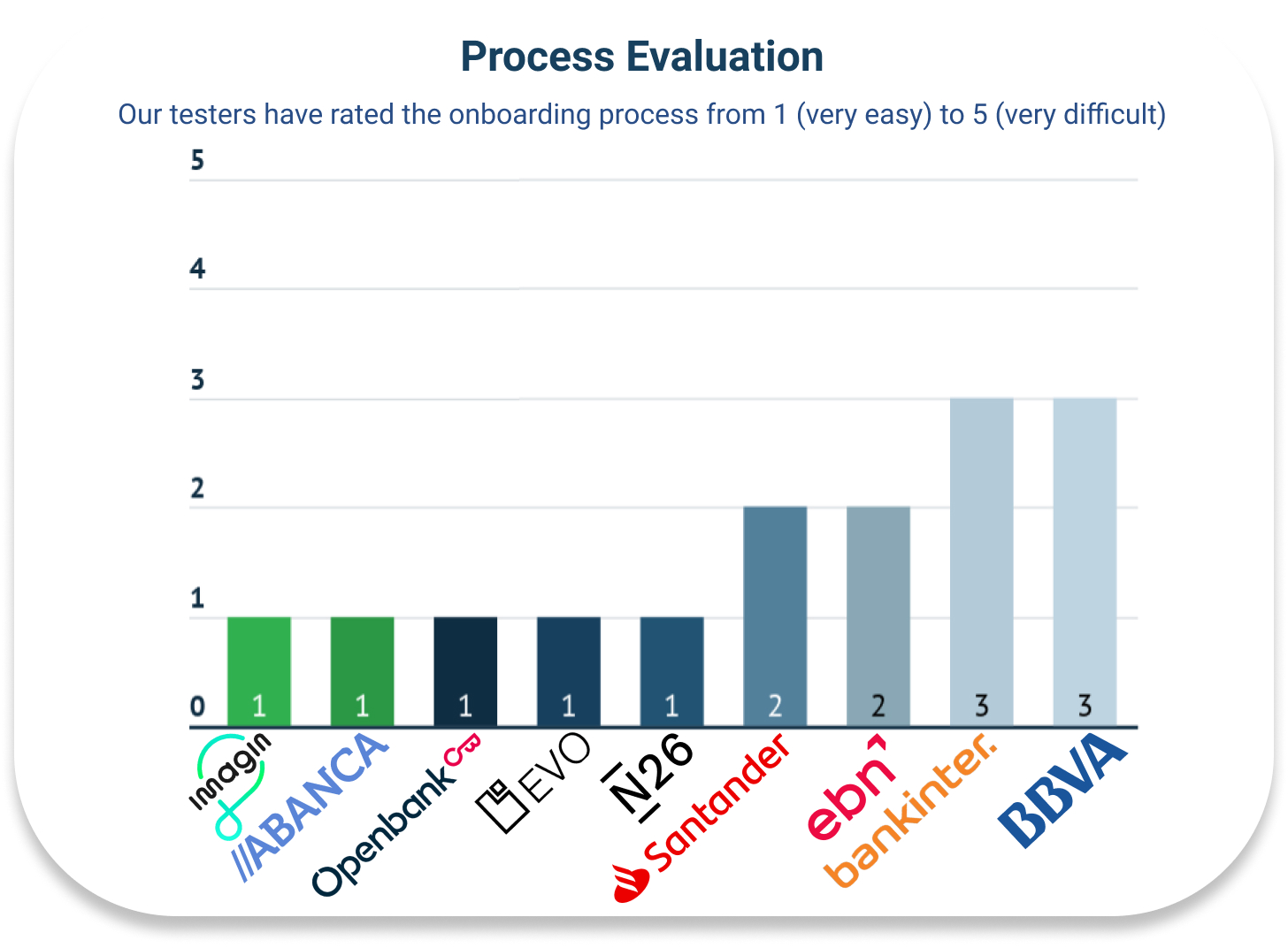

We asked our testers to rate the onboarding process from 1 (very easy) to 5 (very difficult). No bank received ratings of 4 and 5, corresponding to a high difficulty in the onboarding process, thus reinforcing what was pointed out at the beginning of the research: Spanish banks have a very high level of digitalisation. Imagin, Abanca, OpenBank and Evo Banco (in addition to N26) were among the banks with the easiest onboarding processes.

How many clicks does it take to open an account?

During the onboarding process, testers had to count the number of clicks needed to open an online account. This is simple data that can give us a numerical indicator about the process of opening an account, but we must consider the number of clicks as kilometers on a road.

"With the same distance of travel, I can have different travel times (objective measurements) depending on the type of pavement (asphalt, cobblestones) and the layout (highway, mountains). Similarly, I can have positive and negative experiences (subjective measurements) regardless of the time spent: a beautiful route through the hills, even though it may be longer, will be more rewarding for those who appreciate the scenery [...].

The speed of online procedures is an imperative measure, but just as in urbanised areas, we have potholes that slow us down, even in delicate processes such as the purchasing of a product. There are times when it is good to slow down, to make sure that the user has understood and entered accurate data, and then they can go at full speed again.

That said, as the first step in choosing a pathway, each one of us looks at the kilometers and then looks at the rest [...]."

The Methodology:

Between February and March 2021, we asked some of the Spanish testers in our community to open an online account at some of the most important banks in the Spanish territory and to count the number of clicks needed to achieve that goal.

Considerations:

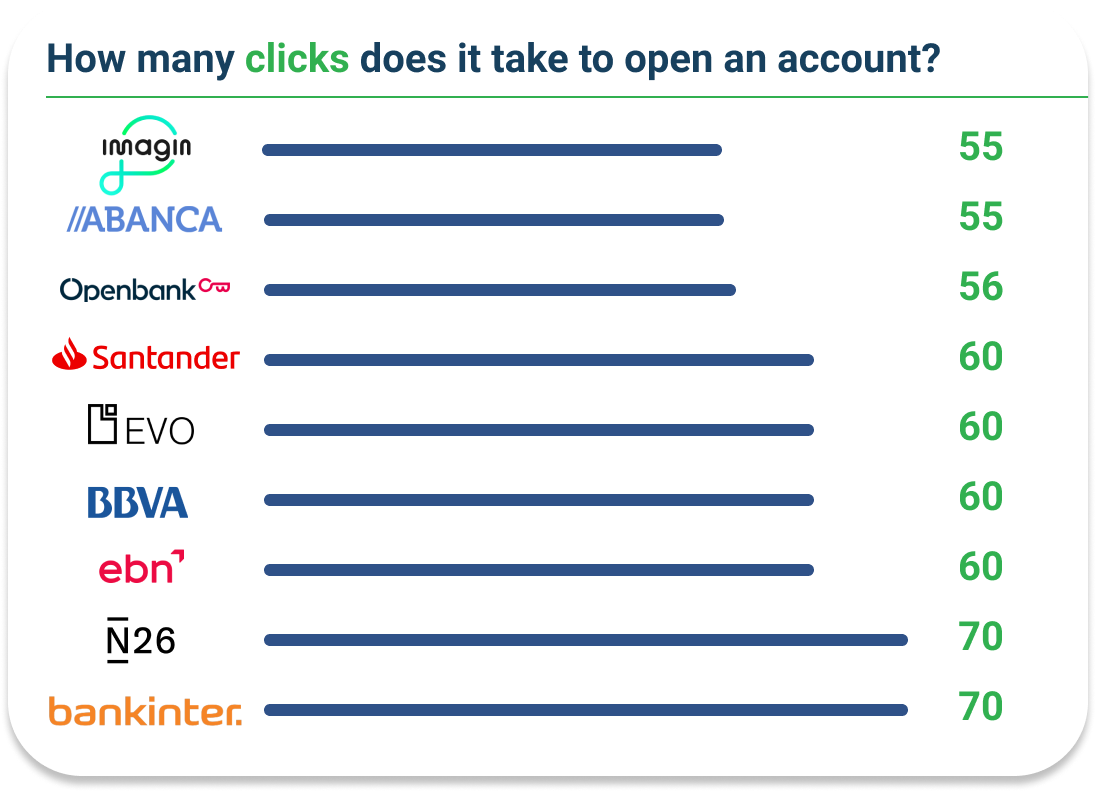

Just like the research regarding Italian banks, the Spanish testers in our community have given us the answer. The number range of clicks for Spanish banks is smaller than that of Italian banks. In Spain, it takes banking customers between 55 and 70 clicks, as opposed to 44-120 clicks in Italy. This is a clear indicator of the high degree of digital transformation in Spanish banking.

However, the number of clicks should not be used as a sole indicator of the fluidity of the process. In the case of banks, the number of clicks usually increases, for example, with the increase of security processes, which in that case, are a reliable index for the user.

The personal identification methods allowed by the banks analysed:

- Imagin: a video or selfie with documents.

- Abanca: a transfer from another account.

- Evo Banco and BBVA: a selfie with documents or a transfer from another account.

- EBN Banco, CaixaBank and N26: a selfie along with documents.

- Bankinter: a recognition process within the application.

- OpenBank: a video call (like Banco Caixa Geral) or a transfer from another account in addition to some documents.

- Santander: a transfer from another account or an account number at another bank.

- Unicaja: a transfer from another account in addition to the

documents.

The results are as follows:

Note: OpenBank, 55.6 clicks

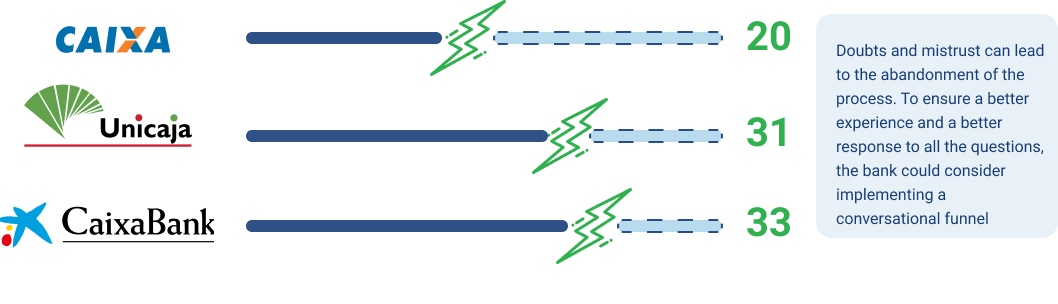

Due to some doubts on the part of the testers who participated in the panel for Banco Caixa Geral, Unicaja and CaixaBank, we stopped while in the document recognition process.

There are also four banks that do not allow you to open an account online:

● Ferratum

● Kutxabank

● Cecabank

● Bankoa

More clicks do not mean a worse experience:

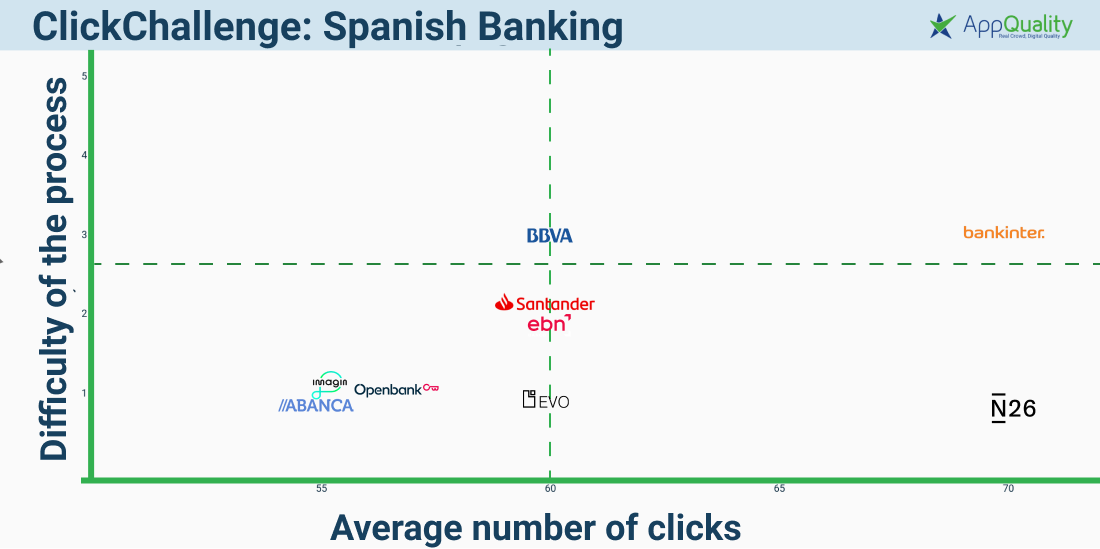

As in the kilometres on a road metaphor, a higher number of clicks does not determine scenery gratification. This is demonstrated by this matrix that relates the average number of clicks with the evaluation of the experience:

For example, to open an account at Evo Banco, it takes 10 more clicks than in Abanca, but both share the same experience evaluation.

Opening an account via an application: How many banks allow this?

We did not stop there. To study the level of digitalisation of the different companies, we asked our testers to check at which banks it would be possible to open an account through an app.

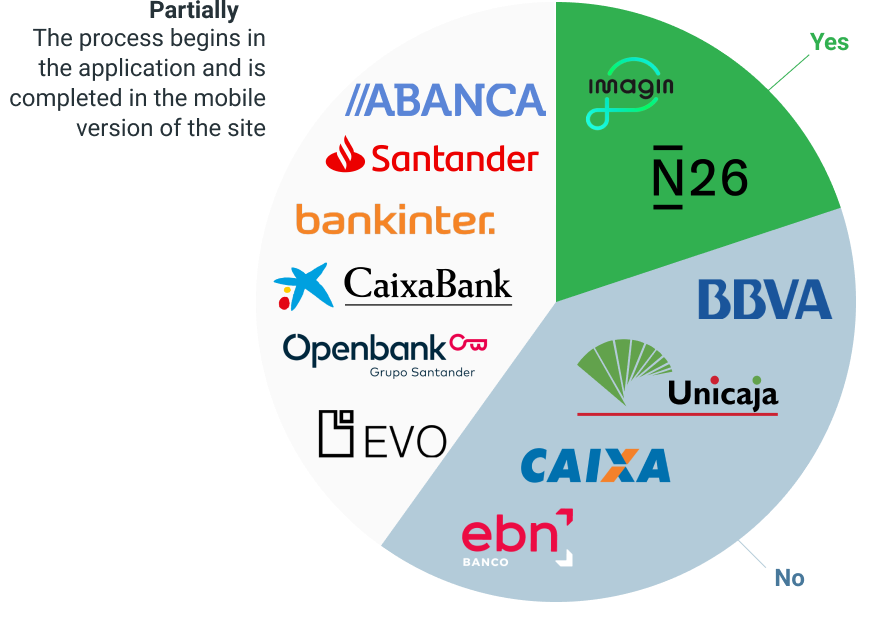

Taking into account that all the banks in question have an application, below we demonstrate those that offer the option of opening an account and those that do not.

While Abanca, Santander, Bankiter, CaixaBank, OpenBank and EVO Banco transfer users to the mobile version of the website (thus making them exit the application), BBVA, Unicaja, Caixa and EBN do not allow registration through the app.

Specific opportunities for increasing conversions in the account opening process

We can divide the opportunities for banks to improve the account opening process into two categories: technical improvements and increased confidence in the account opening process.

Among the opportunities for improvement that were gathered in the test, we can point to: providing more guarantees in the management of personal data, ensuring cost transparency, and the guarantee of an error-free conversion funnel.

Many of these opportunities can be exploited by improving the conversational funnel within the account opening process to support the user at the most critical moments. UNGUESS UX optimization services, along with UNGUESS's bug finding services, offer concrete opportunities to increase conversions.

Conclusion

The Click Challenges were not created with the objective of choosing a winner, and we will not do that in this case either. In fact, each bank has different processes and services that, in most cases, reflect the needs of its consumers. For example, not all of the analysed banks are aimed at private users.

Our advice is to always keep an eye on digitalisation trends and user needs (which are always evolving). Only by listening to and including users in the design, development and testing processes is it possible to achieve the right balance between security, usability and innovation.

Digitalisation in this area is a global trend, but Spanish consumers are already accustomed to a higher level of digital transformation in banking than in other European countries. The challenge for the country's banks will be to keep up with the growing needs and demands of consumers and to solve the technical and experiential issues that can cause the loss of the user today.

Mentioned Sources

1 Study of Digital Banking Maturity

2AppAnnie's latest report